Can I accept credit cards online for free?

Perhaps, free credit card processing is a dream of any merchant. Taking into account the efforts, time, and money they’ve put into business development, avoiding processing fees is a great win. Yet, they continue receiving the transaction, monthly, annual, setup, and dozens of other fees.

Then merchants may notice some payment processors that claim they offer credit card processing for free. But is it true? Is it possible to eliminate the charges, merchants have got used to paying?

In this article, we are going to figure out what stays behind “a zero fee” and why it’s usually not what it sounds.

What is a zero-cost payment processing?

Spoiler alert! There won’t be any costs at all. Firstly, merchants and payment processors cannot avoid transaction fees. That is connected with the charges payment processor pays to the issuing bank and the credit card network.

We can formulate no fee processing the following way.

Zero-fee credit card processing is a payment model when the merchant passes the charges to the customers.

Once again, even though the seller can consign some fees to its customers, it won’t cover all the charges. That is why, when payment processors promise to offer their services free of charge, you need to bethink.

To understand why there is no chance to get it absolutely free, we are going to share the fees composition.

What are the fees the merchant pays?

To accept credit card payments (or any other), the merchant has to partner with the payment service provider. Of course, the seller has to pay for services the payment processor provides. Accordingly, the business meets two main fee types – the wholesale and the markup ones.

The wholesale fees

These are the fees the merchant cannot avoid. Why so? Because there are two fee types in this charge – interchange and network fee. And these are the fees the credit card networks establish.

Interchange fee

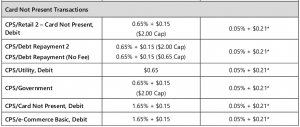

That is the fee that the payment processor passes to the issuing bank. Despite the credit card networks like Visa, Mastercard, American Express, or Discover set interchange fees, it goes to the issuer. This fee is usually a percentage of the transaction and a fixed amount.

Every credit card network establishes its fees, depending on the payment card type (debit, credit, prepaid) and card-present/not present transaction. This fee is the charge for the transaction’s facilitation the credit card network performs.

Card network fee

This is the fee from the credit card network as well. On the contrary to the interchange fee, it’ll go directly to the card brand. These charges are lower compared to the interchange. They are usually no more than 1%. Still, there’s no way to escape them.

As you have already understood, you have to pay for these fees. Not directly to the issuing bank or the card network but to the payment processor. What’s more, you cannot negotiate these charges with them. Assuming this fact, you can see that there is no free credit card payment processing. It’s very unlikely for the payment processor to cover those fees for you. In the long run, the payment processor is a company that works for profit. It’s not a charity. Moreover, surcharging (what is, basically, passing costs to clients) is forbidden in many countries.

The markup fees

These are the fees you can negotiate. Even more, you can search for the payment processor based on these charges. The more flexible approach they have, the lesser value you’ll pay in the end. Here are some markup fees you may face.

- Setup fee. That is the price the PSP charges for its help in opening a merchant account and accompanying help with documents or legal advisory.

- Monthly/annual fee. That is the recurrent fee the payment processor charges for its service. Mainly, it goes for account maintenance, technical support, and so on.

- Online statement fee. That is the charge the merchant pays if he decides to view/receive reports online. Usually, it doesn’t go separately; instead, the processor includes it to the final fee amount.

- Payment gateway fee. The gateway distributes the transactions online. That’s why some payment processors may charge for this service. It may happen if the processor doesn’t own a gateway.

- Chargeback fee. As PSPs take care of merchant’s chargeback disputes, it’s pretty obvious that they demand the sellers to pay for their work.

Surely, there are more markup fees. This is the most flexible part of your expenses. You may not get a free merchant account. Yet, you are free to choose the payment processor at the most affordable cost.

Does surcharging equal the no-fee credit card processing?

Not to be in the maze and avoid zero-fee solutions complaints, let’s try figuring out what “surcharging” is. We don’t want to upset you, but no, those two notions are not the same. The merchant still pays the fixed number of fees and passes some amount to clients.

Usually, the surcharge is an additional checkout fee the customer will pay. Nevertheless, the surcharge will only work for credit cards. For instance, if you are accepting the Visa cards, you need to discuss the surcharging opportunity with Visa.

And though you can decrease your charge pressure, your clients may stay unhappy. That, in turn, will make your website/web-store less attractive to them. So, if you are thinking of “how do I reverse my fees,” surcharging might not be the best option.

Should merchants forget about free credit card processing?

Unfortunately, merchants have to pay fees. Like any other company, the payment service provider offers its services and expertise in the payment processing area. So, there is no chance you will get all this for free.

Nonetheless, you can search for the payment processor that offers fair pricing. Proving a flexible approach and special conditions for some merchants will be a big plus as well. For instance, PaySpacelv has affordable rates. Besides, what does make it more beneficial compared to other processors?

- no annual fee

- no recurring billing fee

- no cancellation fee

- no payment gateway fee

Moreover, normally high transaction amount merchants can discuss special fee structure. That’s how you can reduce your fees, choosing the right payment processor.

One more tip for you. Be precise with the payment model you are choosing (flat-fee or interchange plus). Besides, try to decrease the chargeback ratio as they are often the reason for higher fees.

Conclusions

So, is it possible to get free credit card processing? Unfortunately (for merchants), no. Nevertheless, in this article, we shared what fees are made of. Knowing their types and why you need to pay them, helps you choose the payment processor wisely.

Also, you know there are fees you not necessarily need to pay and can negotiate. Though you cannot enjoy processing services at a zero cost, you can find what fits your size and industry. The PaySpacelv team is glad to answer any questions. You can drop us a line via filling in the short form.