Credit card fraud and how to protect yourself

The vast majority of banks fight online fraud with the help of various software. Specialized institutions develop security systems, implement state-of-the-art identification systems, block suspicious transactions, etc.

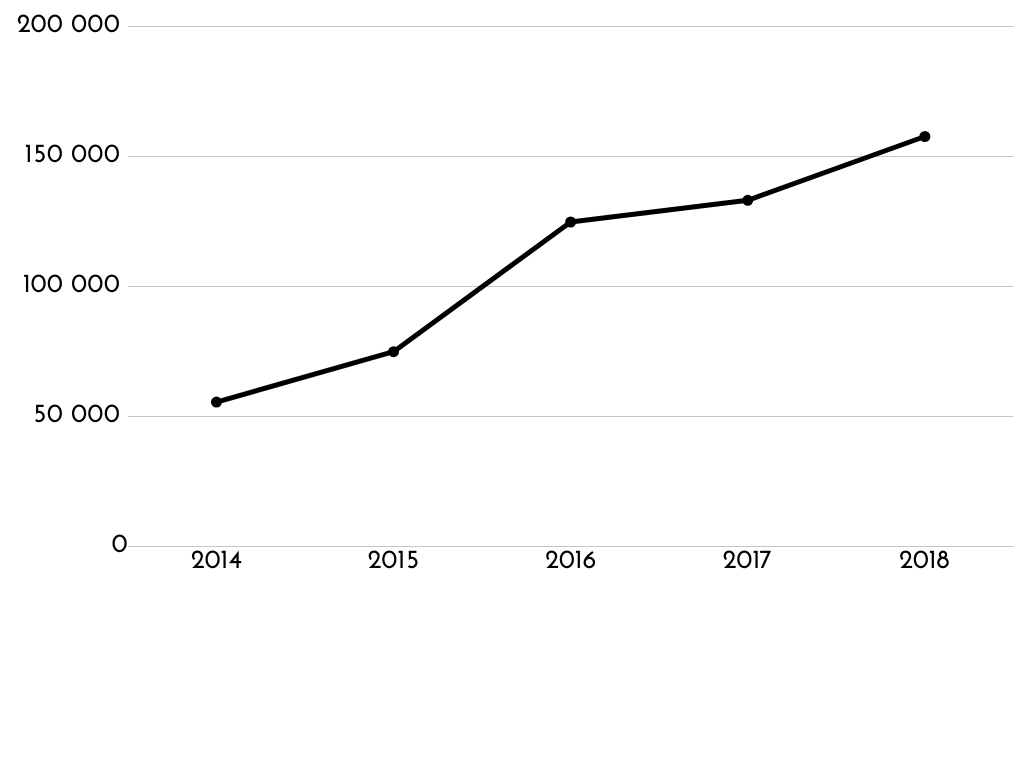

However, despite their efforts, the number of crimes against credit cards is snowballing.

Latest researches show the deplorable result of an increasing amount of fraud:

The main reason for online criminals’ success is the incautiousness of cardholders. When it comes to bank workers, psychological tricks of deception are the most efficient to steal one’s money.

Typically, fraud occurs with the following scenario:

- Fraudsters call cardholders using number changing programs. Thus the incoming call number is determined as the bank number.

- They use a bank employee identity, offering services, or security staff that allegedly detected suspicious activity with client money.

- In the end, they request passwords to enter your account or confirm the transfer of money.

Types of credit card fraud

Credit card phishing

Phishing is a form of online fraud by which scammers steal user data. Attackers trick users into revealing their data, for example, phone numbers, numbers, and secret codes of bank cards, usernames, and passwords of email and social network accounts.

The newest phishing sites use realistic web pages that are almost impossible to find using search. Fraudsters use them to trick people and get their personal and financial information.

Once scammers receive data, they use it to access company information systems to gain access to management mail. Then the criminals send a letter to the employee from this box asking them to transfer money to the account.

Due to the growing number of new sites, it is becoming increasingly difficult for companies to resist phishing attacks.

Credit card skimming

Skimming is one of the types of fraud associated with credit cards. Criminal actions consist in the fact that in ATMs, most often located on the street, hidden devices are installed that allows you to read information from payment cards during the transaction.

Having confidential data on the payment document in their hands, the attackers create a duplicate with the PIN code recorded on the magnetic tape. It allows them to use this payment document for personal gain, for spending money in stores, retail outlets, and online stores.

Who can be a victim of skimming?

Unfortunately, it is difficult for the cardholder who has become a victim of skimming to prove the fact of fraud to the bank. The best and most reliable way to protect yourself from this type of fraud is to use payment cards with a chip and use caution for using the card.

Any credit card owner with a magnetic stripe can become a victim of skimming. The information obtained from a unique device allows attackers to duplicate a bank card. After that, fraudsters can pay with the victim’s funds in online stores or withdraw the victim’s card money through an ATM. Frequently, ATM or POS terminals tend to be an intention for individual skimming devices. They copy the contents of the magnetic stripe of the credit card when using it. Besides, when one wants to withdraw money from an ATM, they must enter a PIN. Fraudsters can find out the password using spy cameras as well.

Ways to prevent credit card fraud

- Choose secure and reliable websites. Fraudsters create a copy of reputable online resources. For example, they can make a copy of the bank’s website or your favorite online store. If you enter your passwords, codes, card details there, they will get to scammers.

- Do not pay for purchases from gadgets you cannot trust. It would be best if you make purchases on the bank’s website, or the banking application only from a personal computer, tablet, phone. Set unique passwords on all your gadgets. If you lose your phone or tablet where a mobile banking application is and where notifications and passwords are stored, immediately notify the bank. A bank employee will disconnect all credit cards from this phone number and block access to the account from the lost gadget. Change the login and password from your account in the same place.

- Do not share your passwords with anyone. No one should know about the PIN code from the card. Disclosing it to anyone is the best way to get it scammers’ gunpoint. It’s better not to save it on your phone and even more so as not to record it on a card. And when entering the PIN code in an ATM or in a store, you should always cover the keyboard with your hand. On the back of the card, there is a CVC / CVV code – three secret digits. They are vital to pay for purchases on the Internet. To prevent fraudsters from spending money on your card, in no case dictate or show anyone the CVC / CVV code. Bank employees never ask for the CVV code from the credit card, PIN-code, as well as codes from SMS that the bank sends. Only scammers are interested in secret codes. The deceiver is ready to pretend to be anyone, to get them out: not only a bank employee but also a relative, friend or even a stranger who is in trouble.

- Connect SMS alerts to the credit card. It is essential for immediate receiving SMS from the bank about all activities on the card. If a message came about a purchase that you did not make, most likely, the scammer used the card. It is worth immediately calling the bank, reporting a suspicious SMS, and asking to block the card. The bank hotline number is on the back of the card.

- Do not follow the links from any messages. Never follow links from letters and SMS from strangers. It could be a malicious program that steals personal data.

The bottom line

All in all, if you notice suspicious activity, you have lost money from your account, you gave information to suspicious people, immediately contact the bank. They will tell you what to do to protect your credit card against fraud and save funds.