How the payment processing industry works

How does the payment processing industry work? That is a question which is so much on business owners’ minds. Hands down, the payment industry is a hard nut to crack. In this article, we will do our best to educate you on its work and show why you need to run a business online.

E-shopping is one of the most popular online activities, according to Statista. Lately, Statista reported that e-sales would skyrocket by 53% in 2021 (compared to 2014). Moreover, Invespcro shares that 47.3% of Internet users make purchases online. Still not selling goods or services online? Well, you need to consider this option.

For this reason, let us be a nutcracker and squash this tough nut for you. We are going to talk about three basic components of the payment processing industry, what they mean, and how they work together.

Introducing the payment processing industry work based on three essential parts

1. The Merchant

You are the merchant. Well, as soon as you decide to go online and sell your goods or services via the Internet. The definition of this term goes like this.

The merchant is an individual or a company that sells goods or services.

It is crucial to open a merchant account to start accepting payments online. The merchant account refers to the agreement between the merchant and the acquiring bank. This agreement allows the seller to accept and process credit/debit card payments. As the merchant signs the agreement, it consents to follow Visa, MasterCard, or other brands’ operating regulations.

How to open a merchant account?

To open a merchant account, you need to perform seven steps.

- Pick the credit card brands you want to work with (e.g., Visa, MasterCard)

- Decide on the payment model which may involve one-time payments or recurring billing

- Analyze your turnover as it influences the established rates by the bank

- Search for a bank (better the local one) to open a merchant account with

- Get your website ready, as it must comply with Visa or MasterCard requirements

- Gather all the documents the bank requires to open an account

- Submit an application form to initialize the procedure of merchant account creation

N.B. Keep in mind that even if we have provided an easy yet complete guide for a merchant account creation, it is much more comfortable to get a payment service provider (PSP) assistance. PSPs have an extensive network of partner banks worldwide. As a result, you have higher chances of opening a merchant account and making the application process smooth.

You may also like Merchant services industry: Everything you need to know about it.

2. The Customer

The customer, aka a shopper, is an essential and inalienable part of the payments processing industry. The shopper initiates the payment process by adding products/services to the online shopping cart and then filling in the credit card details at the secured payment page.

As the latest study has it, 1.92 billion people will shop online in 2019. Consequently, store owners need to pay attention to the customers’ needs and expectations. That includes providing a vast choice of payment methods.

N.B. The best way to build a payment page with a variety of payment methods is to partner with a payment processor.

3. Payments processing

The most complicated part of the payment processing industry work is payments processing itself. Still, as we have promised, we are going to make this procedure easy breezy to understand. Let’s move to the main terms involved in the process.

- Payment gateway – is a software that transfers the transaction parameters from the merchant to the acquiring bank. A payment gateway is a go-between the payment page (form) on the merchant’s website and an acquiring bank.

- Payment processor (or payment service provider) – is a financial institution or a company that merchant picks to process online payments (credit/debit card payments as well as alternative payment methods). So, what is a payment processor? Fair to say it is an intermediary between a merchant, an acquiring bank, a cardholder, a payment gateway, and an issuing bank.

- Acquiring bank – is a financial institution that caters for the bank account of the merchant. The acquiring bank transfers the merchant’s transactions to the issuing bank to receive the payment. As soon as the merchant signs the contract with the acquirer, it can start processing the credit and debit card transactions.

- Issuing bank – is a financial institution responsible for issuing credit cards to the customer. This bank issues cards on behalf of the card networks (e.g., MasterCard, Visa).

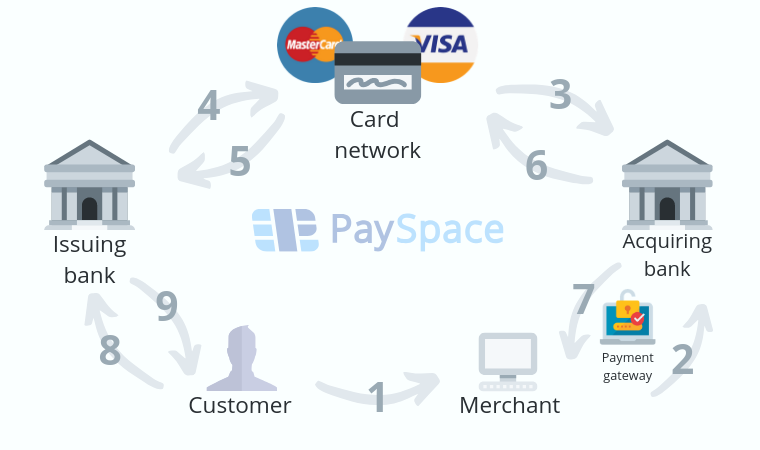

Now, it’s time to learn how all these parts work together.

- A customer lands on the merchant’s website. The shopper adds goods or services to the online shopping cart. Then the payment page appears. The customer fills in the credit card details and presses “Buy Now”/”Submit.” This action starts the payment process.

- The merchant receives the customer’s credit card information. The card details, as well as the purchase amount, are transmitted to the payment gateway.

- The payment gateway sends the authorization request to the acquiring bank based on the credit card information.

- The acquiring bank redirects the authorization request to the card network (Visa, MasterCard).

- The card network processes the request to the issuing bank. The bank makes sure that the credit card is valid.

- If all the information is valid, the card network sends the verification to the acquiring bank.

- In the case of the positive answer, the payment gateway sends a request for the order amount withdrawal to the acquiring bank, followed by the described scheme.

- The card network confirms the transaction to the acquiring bank, and the latter sends the confirmation to the payment gateway.

- That completes the transaction’s processing, and the merchant finds out about its success within 15 minutes.

All in all, payments processing involves all the parties we have mentioned in this and the previous points.

Conclusions

Though the payment processing industry work may seem too elaborate at first sight, it is possible to get the idea when you divide it into parts. The merchant – the customers – the payments processing are three pillars of the payment industry.

Moreover, in this article, we have tried to show how everything interworks. It is feasible to make payment processing even more hassle-free. Just remember, that payment processor is the component that maintains and connects all the payment procedures. So, opt for a trusted payment service provider.

Would you like to learn more about some payment industry components? Leave a comment and let’s dig deeper into this theme!