What’s credit card pre-authorization, and what are its benefits?

Nowadays, you, as a merchant, are up to using various payment techniques. Credit card pre-authorization is one of them. For years it had been proving its efficiency. Taking into account the rising number of fraud, pre-authorization may become the valuable tactics you employ.

In this article, we are going to breakdown what the credit card pre-authorization is. Also, we will discuss its main advantages. This article is a nice fit for merchants who are using pre-auth but want to have a better understanding of it. Besides, it will be useful for those who are only considering using it.

What is the credit card pre-authorization?

First of all, let’s figure out what pre-authorization means.

Pre-authorization or authorization hold is a common banking industry practice. It happens during the transaction’s initiation when the part of the balance becomes unavailable. This is true until the merchant clears the transactions or declines the hold.

Don’t get scared by this definition. In practice, it’s not that hard. The credit card pre-authorization is like any other payment card charge. Nevertheless, instead of debiting the funds from the card straight away, you set the hold on a certain amount. Consequently, the cardholder cannot use the pre-authorized funds. Most commonly, the hold lasts for five days. If the due date expires, you can put the hold once again (if you have the permission). If there is no need to prolongate, the issuing bank releases the funds.

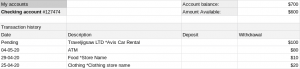

The picture shows an example of how the merchant can hold a certain amount. That reflects the availability of the number of cardholder’s funds.

Anyway, its duration directly depends on the MCC you have. So, some MCCs are eligible for a longer hold period. According to Visa, some rental categories are eligible for seven days. Moreover, there are some industries where the hold is relatively widespread. Pursuant to the same guide, they are bus lines (MCC4131), lodging (MCC3351-3500, 7512), recreation services (MCC7999), and so on.

Pre-authorization benefits

Different reasons may stand behind the pre-auth. Nonetheless, we would like to name several essential authorization hold advantages.

1. Chargeback elimination

By far, the most important pro of the pre-auth is chargeback avoidance. So, the card owner cannot initiate the dispute because you haven’t deducted the funds yet. For merchants, it’s a great option to process the transaction without rubbing through fraudulent activity.

2. Refund avoidance

Plenty of merchants are aware of refunds. Thus, some payment service providers charge refund fees. The credit card pre-authorization saves you from extra spendings. If the customer decides not to buy your goods/services, you simply call off the pre-auth. So, the payment processor won’t charge you because you’ve never withdrawn the client’s funds.

![]()

3. MDR fees evasion

That means you can lower your costs. For instance, most of the card schemes won’t charge the MDR until the time the transaction is actually authorized. Respectively the funds must be transferred from the customer’s account.

4. Payment assurance

With the pre-auth, you may be sure that you are not left alone. In most cases, the hold on funds guarantees the customer will pay. Also, this type of relationship with customers ensures you cover any additional charges.

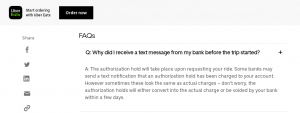

The picture shows how Uber explains the pre-authorization function to its customers

5. Customer’s satisfaction improvement

You build trustful relations with your customers. When you state that you pre-authorize but not deduct funds, they don’t feel afraid to be cheated. Understanding that you only withdraw funds after the customer gets the goods/services builds stronger relations. Also, this “nurtures” more loyal clients.

How do you enable the pre-authorization?

After you see the perks of the authorization, you might wonder how to have it on your site. In this abstract, we are going to share the steps you need to make.

To enable this transaction type, you have to fall under the two essential rules:

- Your payment service provider has to support the pre-authorized transactions,

- Your shopping cart software should be able to send this transaction’s type to the payment gateway.

After you’ve confirmed that the payment provider works with the pre-auth, claim what transaction type you want to process. What should you do when it comes to the shopping cart software? There are two options – the full authorizations or pre-authorizations. State that you are here for the second one.

Though the majority of shopping carts support the authorization hold, some of them don’t. So, you can consult with your payment provider about what software to choose.

Conclusion

Credit card pre-authorization is the instrument not all merchants are aware of. Some industries like travel (hotel bookings, car rentals), taxi services (Uber, Bolt), food (restaurant, bars), etc. actively use this option.

This article pointedly shows what perks you can have after enabling pre-auth. Not only can you eliminate extra spendings but also increase the transactions’ security. It’s also an option of establishing better relations with customers. Consider authorization hold to get the mutual, merchant-customer, benefits.