Credit card processing fees explained

There’s one thing merchants can’t eliminate – credit card processing fees. As they decide to work online or get a POS in the offline store, this term will follow them during their journey. Yet, once the seller gets used to this fact, some other things may pop out.

Commonly, they are the final price the merchants have to pay and the fees’ list. And while it’s possible to accept the price (though it’s high), some charges are hard to understand. Merchants get receipts with an annual fee, PCI DSS compliance fee, and a bunch of others. And that might be confusing.

In this article, we are going to sort everything out. Firstly, we will revise what authorities take part in the processing. That helps to understand why there exists a variety of fees. Secondly, we will take a look at the fees themselves.

Credit card processing fees explained

As we’ve mentioned before, several authorities take part in credit card processing. It’s vital to understand this part to conceive the versatility of fees adequately. In the first part of our guide, we will take a more in-depth look at the authorities involved.

What parties take part in the credit card processing

Payment service providers stand at the forefront of payment processing. These are the companies the merchants deal with. Yet, it’s possible to compare it with a shop-window. It is the first thing the customers see. Nevertheless, there are lots more goods as they walk inside.

The same thing applies to the payment processor. Though it communicates directly with merchants, there are plenty of authorities that stay off-stage. In this segment of the article, we will meet all of them.

- Credit card networks. These are four establishments – Visa, Mastercard, American Express, and Discover. The main aim of them is to control where it is possible to accept the cards. Also, they monitor the communication between merchants and payment card issuers. Moreover, the networks establish the industry’s security standards. Additionally, they make sure the fees are fair for various industries.

- Issuing banks. Simply put, these are the banks that issue the payment cards to consumers. The issuer can be a bank within a country or a bank chain working globally – for instance, Credit Agricole, Raiffeisen Bank, Bank of America, City, etc. What’s interesting, Discover and American Express are not only the networks but the card issuers as well. Issuing banks don’t stop their responsibilities after the card’s issuance. During processing, they check the funds’ sufficiency on the shoppers’ accounts. After the check, they decide whether to approve or decline the transaction. Then they transfer the funds to the merchant’s bank.

- Acquiring banks. They are merchants’ banks. It’s a financial institution where the seller opens an account (commonly with payment processor’s assistance) to accept payments. An acquiring bank takes part in the communication that appears during credit card processing. It functions as the middle-man to fine-tune the relationships between the issuer, payment processor, and credit card network. The acquiring bank sends a request to make sure the customer is able. Then it accepts the payment on the merchant’s behalf. Nonetheless, the acquiring bank always checks the merchant in the first place. Only if the business is stable and legal, the bank will provide it with an account.

- Payment service processor. It’s the company the businesses usually work with. It helps in setting up all-things online processing. Of course, this involves credit card processing fees, about we are talking today. Yet, the payment processor performs a variety of actions and provides a range of services to ease the business owners’ lives. So, the payment processor usually helps in merchant account opening, checks all the documents, assist with dispute management, and so on.

- Payment gateway. It is special software that maintains the online flow of transactions. It accumulates and distributes the transaction information between the acquiring and issuing banks, merchant, and a cardholder. Often, the payment gateway is an integral part of the payment service provider. That’s why there is no need for merchants to look for one more company to get this service.

Well, now you know the leading players. It’s essential to know them to understand how the average credit card processing fees are composited. After this, we can move to the card processing fees and their types & models.

Markup and wholesale fees

Typically, it’s possible to group all the amount of the charges the merchant faces into two groups. To define what fees belong to which category, we need to pay attention to several factors. The first one is the authority that gets the fee. The other one is the fixity of the fee. So, it’s possible to outline the wholesale and the markup fee.

The wholesale fee:

- Merchants cannot negotiate the fees.

- The industry fixes the fees, and its value doesn’t depend on the processor the merchant uses.

- The fees are payable to the credit card network and the issuing bank.

The markup fee:

- Merchants can negotiate the fees.

- The fees will vary from payment processor to payment processor.

- The fees are payable to the payment service provider the merchant works with.

As a merchant, you are the one to pay these fees. But from this short explanation, you can understand that not all the charges go to the payment processor. Nevertheless, the processor will actively use the markups to cover the expenses they face.

Yet, this part of our article explains why it’s vital to pick the correct payment processor. Only the right payment provider will offer the lowest credit card processing fees. That is because the markup fees depend solely on it. So, the processor is in charge of the markup fee’s establishment on top of the wholesale fees.

What are the credit card processing fees?

In this abstract, we are going to discuss the most widespread charges the merchants may face. We are going to cover the fees that go to the financial institutions and payment processors’ one-time & recurring fees.

Wholesale fees

Interchange fee

This is the fee the credit card networks charge for processing the payment cards. This fee is the most notable one. It has a form of the percentage and the fixed amount. The credit card interchange rate is approximately 1.8%+$0.20.

Though the card networks establish the fee, the merchants pay it to the issuing bank. Of course, the charge recipients are not that obvious. Yet, that is what you need to know. You pay the fee to the credit card issuer. But the card networks specify and control the fees. That is because they facilitate the payment.

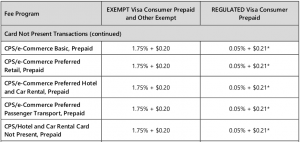

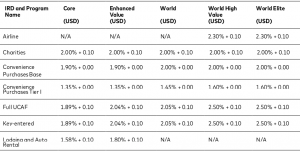

During your business journey, you may face the interchange from Visa, Mastercard, Discover, and American Express. Nonetheless, as Visa and MC are the most popular networks, you’ll encounter them more often. Each network charges a different fee amount. Still, you cannot negotiate it. The rates will vary depending on the card & transaction type and the industry. We are sharing some examples of Visa credit card processing fees and the Matercard ones.

based on Visa and Mastercard

Network fee

This fee goes directly to the credit card network. Unlike the interchange fee, the network one is not that high. It usually varies around the 0.05% mark.

Markup fees

These are the fees we can call concurrent ones. Usually, they are not directly connected with credit card processing. Yet, merchants pay them for the variety of services the payment processor. All-in-all, the unity of those services will ensure the card processing flows securely, fast, and smoothly.

- Setup fee. This is the price the seller pays to open the account. It is essential as usually, the payment processor assists the merchant through the whole process. That will include getting the account in the correct acquiring bank, legal help with documents, and so on.

- Cancellation fee. Contract compounds the merchant’s and payment provider’s relationship. Should the merchant stop it, it has to pay the cancellation fee. Usually, this fee is rather costly. So, make sure if the payment provider charges this fee. And if yes, how big it is.

- Monthly (annual) fee. This is the fee the payment processor charges the merchant to keep the account running.

- Withdrawal fee. This is the charge that may occur when the merchant transfers funds from the payment processor’s account to its business account.

- PCI compliance fee. The payment processor may demand this fee only if it helps with the keeping up with the PCI standards. This fee helps the processor to cover the possible charges if your company is not PCI DSS compliant.

- Recurring billing fee. This is the fee the payment provider may charge the merchants to enable the clients’ payment withdrawals on the pre-arranged basis. If you work on the subscription-based model, this might add some value to your final check.

- Chargeback dispute fee. This is the payment the merchant makes for the processor’s assistance. This fee is essential for companies from the high-risk industries.

The combination of the wholesale and markup fees will define the final amount the merchant pays. Sometimes, the credit card processing fees small business faces are overwhelming. That is why it’s crucial to be able to negotiate the markup. Some payment processing companies are pretty flexible when it comes to fees calculation.

What are the fees payment models?

So, how much are credit card processing fees? They will depend on the payment model the merchant chooses. There are two most widespread ones – flat-rate and interchange plus.

- Flat-rate model. This model means the merchant pays the percentage of the transaction despite its amount. Interchange fees, network fees, and markup are the parts of this payment model.

- Interchange plus. In this case, the merchant pays the interchange fee and some percentage the payment processor states. This “plus” amount might be whatever the processor decides.

The flat-rate fee is the easiest model to understand. Nevertheless, it doesn’t mean it’s the cheapest one. Of course, the merchants are free to choose any model they wish to.

Conclusions

As you can see, there is a variety of fees the merchant faces. And most of them are impossible to eliminate. So, to find the fair prices, you need to research the right payment processor. Should you find one, you will get a guarantee of no hidden charges and a flexible approach. By this, we mean credit card processing fees for small business can be lesser. And this is possible if you partner with the correct payment processor.

Besides, this article gives merchants a better understanding of the existing fees. Knowledge is power. And this power will help you eliminate hidden or irrelevant fees. Once again, there are interchange and network fees you cannot negotiate. So, we just advise you to prepare to pay them morally.

Then comes the constellation of the markup fees you can (and should) influence. Read attentively, what credit card processing fees the processor is going to charge. Make sure it offers all the services you need.

That will sum up the fees you are going to pay to be able to accept payments from your clients. Should you have more questions about payment processing and the fees, feel free to reach us up via the form.