Setting up ACH billing: 6 things to know before you do it

ACH transfer payments are rising to prominence. As stated by the National Automated Clearinghouse Association (Nacha), Q1 2019 ACH Network Volume increased up to 5.8% over Q1 2018. The time is ripe to implement ACH billing at your website. Yet in reality, the majority of merchants struggle to do so. This article gives one the first glimpse of ACH and provides a list of six things to know before setting up ACH billing.

What does ACH stand for?

In banking, ACH is the Automated Clearing House network. It enables electronic payments and automated money transfer. Simply put, ACH is a way to transfer the funds without using credit cards, paper checks, and wire transfers. Automated Clearing House only processes eCheck payments.

How does ACH network work?

The ACH system comprises computers, working simultaneously, to process payments automatically. Neither payer or payee needs to handle the payments manually. ACH is a so-called “batch” processing system that processes millions of transactions at the end of the day.

What is an ACH transfer?

An ACH transfer is an electronic, bank-to-bank transfer run by the Automated Clearing House network. There are four types of ACH transfers:

- external funds transfer;

- person-to-person payment;

- bill payment;

- direct deposit from the employers and government benefit programs.

Setting up ACH billing: 6 things to know before you do it

There are six key things to learn before processing ACH. Here are the six most essential facts on ACH billing you better be aware of:

1. ACH payments processing is cheaper than credit card processing

That’s a good start, huh? Unlike credit card transactions that demand a percentage per transaction fee, ACH payments require a flat fee (e.g. $0.60 cents, regardless of the total sum).

Let’s say your average check amount is $100. A regular credit card transaction fee is 2,9%+30 cents. Hence, once a client purchased your $100 product via Visa, you pay $3.2+30 cents to a PSP and save all the rest ($96.8).

Speaking about ACH billing, you’ll pay $0.60 to a PSP and keep $99.6. You might think that the difference isn’t that impressive, so why wasting time setting up ACH? Well, imagine that an average check amount is not $100 but $10 000. You’ll still pay your $0.60 if processing ACH and 2.9% +30 cents if accepting credit card payment.

Keep in mind, the larger your average check amount, the better the savings. Check out the transaction fees every merchant can face.

2. It takes time to process ACH payments

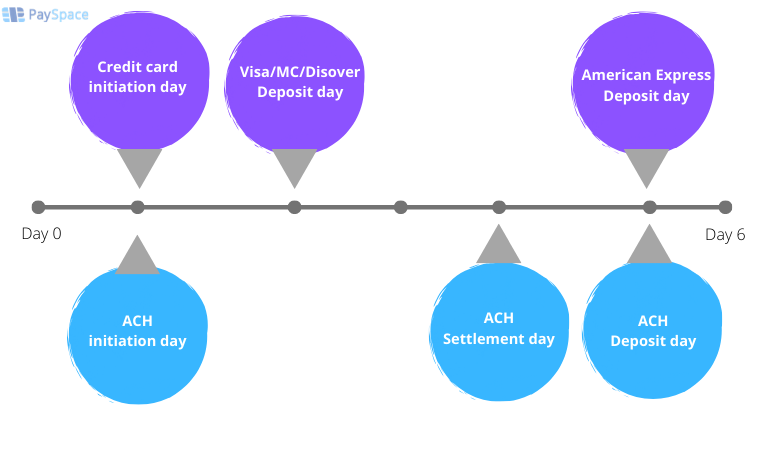

Credit card payment processing takes up to three days. Processing ACH requires from three to five days. By considering the time factor, you can forecast the cash flow. It also helps to predict the regularity of future payouts.

Take a look at the following infographic to compare the ACH and credit card payment processing:

The time difference between ACH and credit card payment processing

3. ACH billing is different from credit card payments

Though obvious, the point is crucial. Both ACH and credit card payments come out of the customer’s bank account. The form of payment, however, is entirely different. When paying via a credit card, a client prints down his credit card details validates the transactions, and that’s it. In ACH billing, a client allows you to make a withdrawal from his bank account by providing a personal routing and account number. No worries. The process is completed automatically, once a client presses “submit.” Learn more about ACH payment processing.

4. Be ready to pay or face the NTF transactions

When processing the transaction, the system only checks if the account exists at the routing number. It doesn’t check whether there enough funds available for the successful purchase. That inevitably leads to NTF (not sufficient funds) transactions. The only way to prevent NTF is to set up a check guarantee or a check verification, which will cost you extra.

5. ACH transaction fees are debited apart from other transaction fees

Processing credit card payments and ACH payments require two different merchant accounts. Either you find a PSP (payment system provider) that processes both ACH and credit card payments, either you will have to overpay for using two different payment gateways. That’s a waste of both money and time.

6. ACH billing has individual dispute policies

As stated by NACHA, the organization that establishes the Automated Clearing House (ACH) network rules, there are just three reasons why people can apply for an ACH payment dispute:

- The account holder never authorized the transaction;

- The transaction was processed on a date earlier than authorized;

- The amount is different than authorized.

When credit card payments processing, the client can apply for a chargeback. Mostly it happens when he/she is not satisfied with a purchase ( or changed his mind about its suitability). If the bank finds a dispute valid, the funds are charged automatically from the merchant’s bank account and sent to the client’s bank account. In the case of ACH payment processing, the unsatisfied client has to provide a written statement that includes one of the reasons mentioned above. ACH billing, at least to some extent, is more protective of unscrupulous clients.

Summary

Now when you know the ACH billing pros and cons, you can make a final decision. Keep in mind the recommendations to exclude unpleasant surprises. Wondering how to enhance your business in 2020? Check out seven high-end eCommerce trends to expect in 2020.