Why virtual banks are the future

Virtual banks haven’t appeared by chance. The modern demands and change of customers’ behavior induced the emergence of new banking culture. The youngsters feel fine using smartphones for banking needs. So, 82% of 18 to 24-year-old manage their funds and pay via phone.

In this article, we will sort out what virtual bank is, and what services it offers. Moreover, we will answer why it fuels so much competition in the financial sector.

Getting clear with the main terms

People who are far from all that banking and financial stuff may mix up “a virtual bank” and “an Internet bank.” These things are not the same. And this is why. The virtual bank definition clearly states that:

“The virtual bank has no physical branches. It offers its services and products via the Internet or other electronic means.”

What is virtual banking?

Virtual banking stands for products and services the virtual banks offer online and let customers evade contacting the physical offices in person.

In contrast, the Internet or e-banking is a bunch of online services offered by the bank that runs the physical branches.

To understand why virtual banking is a prominent trend, let’s take a look at its genesis, current state, and the benefits that induce its bright future.

Why have virtual banks emerged?

The competition in the financial sector is tough. Banks strive to keep up with all the innovations the non-bank financial institutions implement. And the rise of the FinTech makes it even harder. The “birth” of the virtual banks might be the answer and the fresh impetus for traditional ways of managing and using funds.

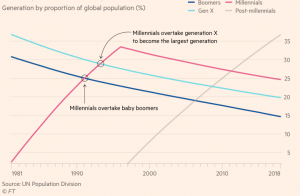

Let’s take a look at some numbers to prove our thoughts. According to the Financial Times, millennials and post-millennials (Gen Z) are the two most populous generations.

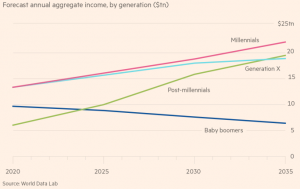

And we know, these two generations are very tech-savvy and extremely picky when it comes to technology and innovations. Moreover, by 2020, millennials will amount to 35% of the global workforce. As a result, banks need to soak the Gen Y demands as they are the most solvent part of the modern population.

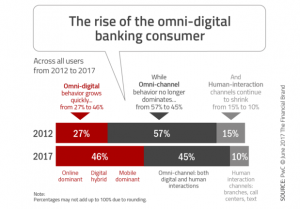

Besides, the younger generation is switching to the omni-digital approach, which leaves the omni-channel approach behind. The omni-digital approach stands for using various consumption channels but only digitally. As The Financial Brand has it, this segment now reaches 46%. This number makes bankers change strategies and implement new technologies.

“The Now” of the virtual banks

Asia: Licensing and new approaches

Although some virtual banks emerged in the early 90-s (e.g. ‘93-born Manulife Bank), Asian tech faces some difficulties. For this region, the main one is licensing (due to high capital requests).

The countries standing at the forefront of the financial technologies, like Singapore and Hong Kong, seem to find a solution. The Monetary Authority of Singapore will issue five virtual bank licenses in 2019. That will blend the borders of bank sector and non-bank financial companies. Thanks to the license, financial establishments mustn’t have a physical bank core to be called “virtual bank.”

The Hong Kong Monetary Authority gave away eight virtual bank’s licenses in May 2019. Mostly, these banks are joint ventures of the financial establishments, tech giants, and the biggest Asian banks. As you can see, different sectors mix to provide a one-of-a-kind experience to individual and corporate clients.

Malaysia, China, and Taiwan are also willing to join the run. That, for sure, makes Asian’s banking sector a highly competitive one. But competition makes people think differently. So, let’s see what products and services Asian customers will experience in the end.

Europe: new mindset and selection of services

Let’s take a look at the situation in Europe. The technology leader here, without a doubt, is the UK. The licensing for the UK virtual banks is pretty straightforward. The bank needs to:

- get authorizations from the FCA*,

- receive the license from the PRA**,

- have €5 million of capital resources and €1 million of the buffer capital.

*Financial Conduct Authority

**Prudential Regulation Authority

First Direct, B, Monzo, Monese, Starling, Revolut, are only a few virtual banks to name. Nevertheless, Monzo and Starling stand out of this list. Starling now has 490,000 virtual bank accounts, and Monzo holds 15% of the newly opened bank accounts (as of 2019).

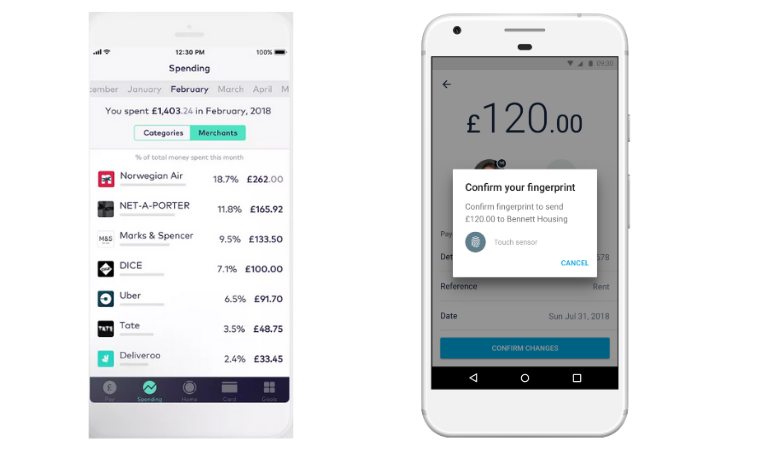

picture showcases spending behavior by Starling (on the left)/security measures by Monzo (on the right)

Why Monzo and Starling are special?

These virtual banks give a lot more than just traditional banking products like loans or payment cards. With Monzo and Starling mobile-only banking, customers can:

- track real-time transactions,

- understand their spending habits,

- know the current balance,

- send money to family/friends,

- get exhaustive fraud prevention tools,

- enjoy user-friendly interface (unlike big branch bank’s apps),

- experience top-notch customer support.

These features of the virtual banks challenge the way brick-and-mortar banks should develop and implement new technologies.

Why virtual banks can be ahead of the traditional ones in the nearest future

The logic of the virtual bank differs drastically from the brick-and-mortar one. Though physical banks run e-banking application, they are commonly mazy, impractical, and outdated.

At the same time, virtual banks’ founders make the most of the modern technologies. It includes machine learning, AI, fraud prevention tools, authorization means, and so on. Besides, virtual banks’ apps use the best UX practices and have a gut-feel interface.

Why are virtual banks the future?

– The lower virtual bank rates. As virtual banks can operate without physical offices and have lesser staff, they can offer lower processing fees. How do they earn then? Well, these banks provide loans, overdrafts, and offers. Some may offer special cards with an additional number of features and services (insurance, withdrawal limits, etc.).

– The omni-digital approach. These banks focus on your online activity. As the omni-digital approach is soon to outnumber the omni-channel one, banks need to cater to customers’ online requests. Monzo & Starling connect Google Pay and Apple Pay and let customers manage a bank account with the help of app and smartphone only.

– Better customers’ understanding. In virtue of AI and machine learning, virtual banks’ staff will offer you a personalized package of banking products. While physical branches’ managers sell all at once, virtual banks’ workers may suggest the services you really need.

– Enhanced security means. Many banks use a 3D-Secure methodology, offering you to confirm your purchase in-app or via a one-time passcode. Another security layer is entering your PIN code alongside with your fingerprint or using face recognition. Some banks will send you personalized links to enter the app. That eliminates passwords’ use and lowers the phishing threat. Is virtual bank safe? Well, above-safe in our opinion.

Conclusions

The virtual banks have made a huge step forward in recent years and continue to grow the market share. Recent studies share that customers show 88% of the satisfaction level when it comes to digital-only banking (2018). That is 20% more than traditional banks’ positive experience.

According to the Global Banking Outlook 2018, customers showed so much loyalty to virtual banking thanks to personalized experience, easiness, and transparency. We also consider these factors as the key ones. Moreover, we expect new products emergence, enriched customer experience, and hardened security measures.

What factors have convinced you that virtual banks hold the future? Should we cover the rise of the challenger banks in the Middle East region and the Americas? Leave a comment and subscribe to our blog to be in the know of the latest FinTech trends.